johnp

Well-known member

...... My folks sold it 16 years ago for 680k. Two years ago my friends boss bought it for 965k. That's outrageous........

btw over 14 years that works out to average annual gain of 2.53%.

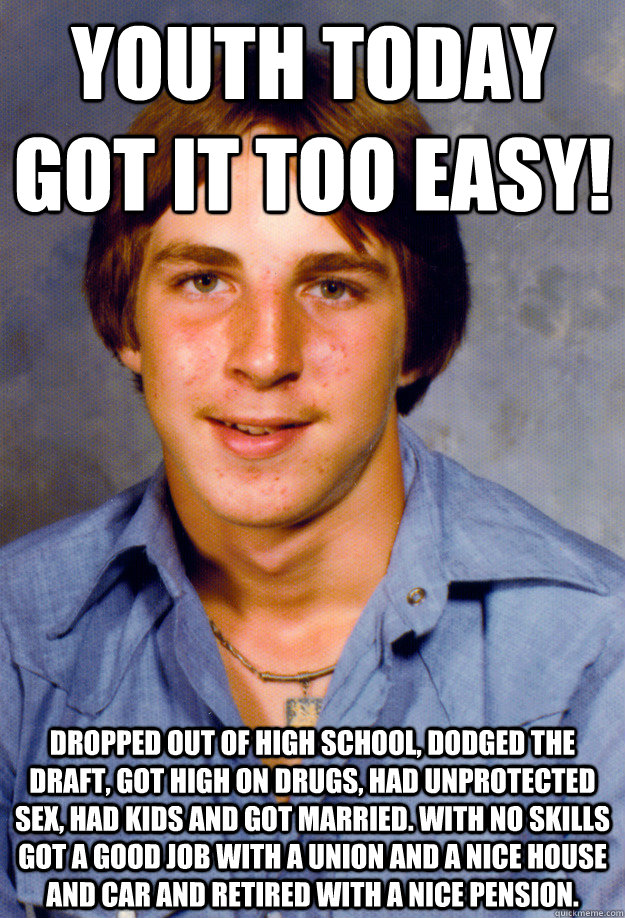

Lots of research shows real estate is not a great long term investment. Most people are leveraged and do really well or really badly - and you don't read about the guys that get wiped out. They're not surfing GTAM since they are holding down 3 jobs to dig themselves out.