what do you call the guy that graduated last in his class at med school?? ..... doctor

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Coronavirus

- Thread starter nobbie48

- Start date

- Status

- Not open for further replies.

Raised the normal 24% by one or cut in half for covid and already started the ramp back up?Credit card company just raised interest on my card by 1%, and put in a provision to bump it another 7% upon sending written notice.

Trials

Well-known member

Didn't they also say UV kills it so Trump wants to light you up with intense UV from the inside, so the UV can kill the virus:

such a shame that will also attack your immune system.

such a shame that will also attack your immune system.

Do you think Donald T. will volunteer for testing that one, it would be a very patriotic show of confidence,

and great television

Do you think Donald T. will volunteer for testing that one, it would be a very patriotic show of confidence,

and great television

Trials

Well-known member

Then I Definitely want to watch them light up Mr. president from the inside with UV on CNN, it sounds spectacular.I ran a printing press with a uv drier. Scarey stuff sometimes. It was quite normal to have a couple of small fires every week.

Was it previously around the 13% mark?Credit card company just raised interest on my card by 1%, and put in a provision to bump it another 7% upon sending written notice.

Maybe he noticed that welders have a lower corona infection rate?

JT commercial rent plan is out. I'm not sure about it. It is good that the landlord takes a beating too. Every other business is, just because you own property shouldn't make you immune to the beating.

For rent less than 50K per month, federal/provincial government pays 50% of base rent to mortgage holder (what if there is no mortgage?), tenant pays 25% of rent, landlord loses 25% of rent. That was base rent only, any additional items are still tenant at 100%.

www.ctvnews.ca

www.ctvnews.ca

For rent less than 50K per month, federal/provincial government pays 50% of base rent to mortgage holder (what if there is no mortgage?), tenant pays 25% of rent, landlord loses 25% of rent. That was base rent only, any additional items are still tenant at 100%.

Deal reached to lower rent by 75 per cent for small businesses, PM Trudeau says

Prime Minister Justin Trudeau has announced that an agreement has been reached with all provinces and territories to implement the promised rent assistance program for businesses. It will lower base rent by up to 75 per cent for eligible small businesses that have been impacted by COVID-19, if...

19Was it previously around the 13% mark?

holy smokes. pray tell what lovely establishment is this card from?

PC Financial. It's free. Get's me grocery points and maybe car rental insurance. I pay it off, so the rate is of lesser concern.holy smokes. pray tell what lovely establishment is this card from?

Edit: Don't the low interest ones all come with a fee?

Last edited:

ah yes.PC Financial. It's free. Get's me grocery points and maybe car rental insurance. I pay it off, so the rate is of lesser concern.

Credit card company just raised interest on my card by 1%, and put in a provision to bump it another 7% upon sending written notice.

We have an unsecured LOC with TD on a sliding prime+% interest scale. It's been trending down, but is still not a bargain rate by any stretch, although lower than any credit card.

Then TD sent me a thing in the mail a few days ago offering a pre-approved personal loan at less then half what we're paying on the LOC.

I called the up and asked if they could just lower the rate on the LOC versus me going through the hassle of transferring the balance of the LOC to the PL and we could call it that.

Nope.

I don't get it. I guess they like making work for themselves.

My BMO world elite card is 17%, and has a $100 yr fee. I dont carry a balance so dont care. I got a Homedepot card when I was doing a porject since they offered my $100 to sign up. Interest rate was 26% pre covid. I cut it up after the project was done.

My guess is defaults on credit cards and unpaid balances will go to the moon in the next couple months. The poor folks that live cheque to cheque and fill in with a credit card, have been binge shopping on Amazon, or just mistimed a large purchase to be out of work , YIKES! its gonna get ugly.

My guess is defaults on credit cards and unpaid balances will go to the moon in the next couple months. The poor folks that live cheque to cheque and fill in with a credit card, have been binge shopping on Amazon, or just mistimed a large purchase to be out of work , YIKES! its gonna get ugly.

One of my wifes ex co-workers popped out a few spawn in rapid succession (only months of work in between IIRC). Full one year mat leave each time. Three cars, 1 mil house. Got canned early this year (industry realignment due to changes douggie made) and was job hunting. Apparently they had been riding the LOC hard to support the standard of living they wanted with only one salary for years. Now, the near-term prospects are her being hired are crap and they are freaking out. The problem with riding the debt wave is if something happens at the bottom, you may not be able to get back on top.My BMO world elite card is 17%, and has a $100 yr fee. I dont carry a balance so dont care. I got a Homedepot card when I was doing a porject since they offered my $100 to sign up. Interest rate was 26% pre covid. I cut it up after the project was done.

My guess is defaults on credit cards and unpaid balances will go to the moon in the next couple months. The poor folks that live cheque to cheque and fill in with a credit card, have been binge shopping on Amazon, or just mistimed a large purchase to be out of work , YIKES! its gonna get ugly.

Roadghost

Well-known member

A warning for those planning a ride north to Orangeville this weekend. The Town has passed enforcement fines of $500-$10,000 for anyone breaking social distancing rules. If you're caught doing anything other than essential business (grocery shopping, etc.) you run the risk of being fined. Law enforcement will be out this weekend cracking down on people who are outside without a reason.

Not sure if Caledon has passed similar fines, but if you're going to the Forks or out for a ride with friends you could be pulled over and fined under the letter of the law. This past week there have been too many people out on the road and politicians have noticed and are cracking down.

Not sure if Caledon has passed similar fines, but if you're going to the Forks or out for a ride with friends you could be pulled over and fined under the letter of the law. This past week there have been too many people out on the road and politicians have noticed and are cracking down.

Robbo

Well-known member

There is no fine for non-essential travel in the Orangeville bylaw. The fines are specific to 1. breaking social distancing guidelines and 2. use of recreational amenities.

The fine range is $500 up to $100k.

As long as you are following the bylaw, you cannot be fined. Use common sense and keep your distance if not living in the same household.

We are not operating under a formal lockdown order in this province.

There is no law stopping you from going out whether essential or not.

People are encouraged to stay home as much as possible.

Sent from my iPhone using Tapatalk

The fine range is $500 up to $100k.

As long as you are following the bylaw, you cannot be fined. Use common sense and keep your distance if not living in the same household.

We are not operating under a formal lockdown order in this province.

There is no law stopping you from going out whether essential or not.

People are encouraged to stay home as much as possible.

Sent from my iPhone using Tapatalk

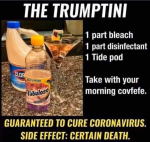

We need a good laugh now and then.

- Status

- Not open for further replies.