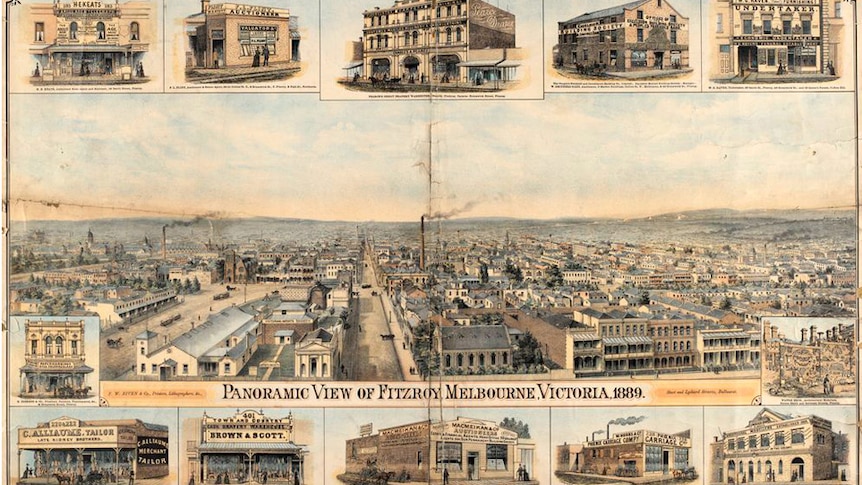

Bubbles are pretty simple in essence or we could call it collective stupidity.

NFT anyone?

www.abc.net.au

www.abc.net.au

www.mhs.mb.ca

www.mhs.mb.ca

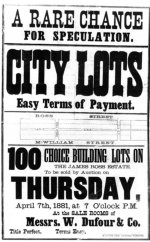

If I recall some of those lots didn't finally sell til a century later,

NFT anyone?

The history of housing bubbles - ABC listen

Housing bubbles have a tendency to burst—look no further than the experiences of Ireland, Spain and the United States in recent years—and the aftermath can be serious; the US collapse plunged the world into economic crisis. So is there a house price bubble in Australia’s capital cities? Stan...

Manitoba History: The Great Winnipeg Boom

Winnipeg's crazy real estate boom in the early 1880s.

www.mhs.mb.ca

www.mhs.mb.ca

If I recall some of those lots didn't finally sell til a century later,