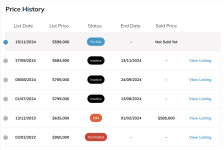

If all goes as is (expected cuts) I expect 5 year fixed rates in the 3s in 2025 with some shopping around. So maybe 1% to 1.5% higher then they are now and many--even most can likely deal with that. I think 2025/26 renewal people dodged the worst of it.Over 1 million mortgages will renew in 2025 . You’ll see the flames from outer space . My mortgage broker gal pal is predicting for sale signs like an American election . Big and everywhere.

Sent from my iPhone using GTAMotorcycle.com

Now if things don't keep going as is and they raise rates or even just hold them....