A lot of our tax laws are designed to funnel money to the banks. In business you are penalized for paying stuff off.You get a better rate if you put down 19.5% than 20% because at 19.5% the banks have zero risk as it’s CMHC backed. What the ****? I work my ass off to get more money down but get screwed because the banks see me as higher risk then the guaranteed no loss of the guy with 19.5%.

Get rid of them…useless.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

COVID and the housing market

- Thread starter mimico_polak

- Start date

D

Deleted member 50930

Guest

You get a better rate if you put down 19.5% than 20% because at 19.5% the banks have zero risk as it’s CMHC backed. What the ****? I work my ass off to get more money down but get screwed because the banks see me as higher risk then the guaranteed no loss of the guy with 19.5%.

Get rid of them…useless.

I am so frustrated with banks and this convoluted game called mortgages

Call other lenders. We stepped away from the Big 5 to MCAP and are very happy.I am so frustrated with banks and this convoluted game called mortgages

D

Deleted member 50930

Guest

Call other lenders. We stepped away from the Big 5 to MCAP and are very happy.

Yup. I am using a broker now

Financial literacy should be part of the curriculum here

100% agree.Yup. I am using a broker now

Financial literacy should be part of the curriculum here

A lot of our tax laws are designed to funnel money to the banks. In business you are penalized for paying stuff off.

Yup. I am using a broker now

Financial literacy should be part of the curriculum here

So the government has a track record of propping up banks. Isnt teaching financial literacy a dangerous thing for banks? Sadly, cynical me sees the crap they choose to teach as part of the same system designed to prop up govt and their friends (whether little time spent on financial literacy or WE indoctrination into govt spending good).100% agree.

It is an interesting situation. Insurance is designed to get you back where you were. Knowing that houses in your neighbourhood are ~1M now, do you build the same house or do you try to add some money and hope your house is worth a lot more?wouldnt surprise me

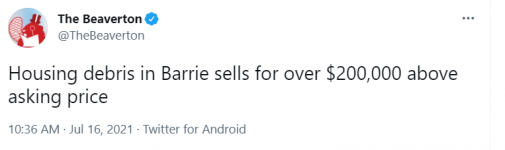

View attachment 49999

D

Deleted member 50930

Guest

It is an interesting situation. Insurance is designed to get you back where you were. Knowing that houses in your neighbourhood are ~1M now, do you build the same house or do you try to add some money and hope your house is worth a lot more?

Interest is cheap, build it bigger

Not that simple with insurance involved. A friends shop burned down and insurance said that in order to get a cheque, it had to be built as close as possible to the original. He tried the argument of I will build a shop and you give me the money and the insurance company flatly denied that option. Very annoying.insuramce company interpreted it as they were only required to rebuild the building as it was, The owner was then free to remove it and rebuild if they wanted. Just a prick interpretation. The reasonable interpretation would be an agreed value to rebuild.Interest is cheap, build it bigger

Last edited:

Agreed. I also know of homeowners who have had houses totally destroyed due to fire and they had to build it back as close as possible to original value.Not that simple with insurance involved. A friends shop burned down and insurance said that in order to get a cheque, it had to be built as close as possible to the original. He tried the argument of I will build a shop and you give me the money and the insurance company flatly denied that option. Very annoying.insuramce company interpreted it as they were only required to rebuild the building as it was, imthe owner was then free to remove it and rebuild if they wanted. Just a prick interpretation. The reasonable interpretation would be an agreed value to rebuild.

One of the pictures was very confusing. There was a furnace in a driveway and the blower wheel had been pulled out of it and was laying nearby. I dont think it could have come out of a basement based on the damage so somebody had probably either installed or stored it in their garage.

Be very careful of how you spend the insurance money as there is usually a cap. A client had a house fire and it wasn't a total loss but after the smoke in the air cleared the smell of it in the undamaged clothing, carpets and drapes remained.Not that simple with insurance involved. A friends shop burned down and insurance said that in order to get a cheque, it had to be built as close as possible to the original. He tried the argument of I will build a shop and you give me the money and the insurance company flatly denied that option. Very annoying.insuramce company interpreted it as they were only required to rebuild the building as it was, The owner was then free to remove it and rebuild if they wanted. Just a prick interpretation. The reasonable interpretation would be an agreed value to rebuild.

The restoration company spent a bundle on cleaning those and when the bills were tabulated insurance didn't cover the rest of the rebuild so he was out of pocket.

Then as they tried to use the soft goods the smell of the smoke was still there so they ended up being discarded. Money down the toilet.

Someone else I knew had a house fire and had to move into a hotel during rebuild. The insurer was trying to chisel down the payout by saying the $500? a week hotel food tab should be offset by the $200? a week they normally spent on groceries. He argued they only spent $100 a week. It was a long time ago so numbers are examples.

Check how much alternate accommodation your insurance allows. An agent friend told me typical renters contents insurance only had 15% for accommodation. If there's $10,000 insurance that's $1500 for rent. If the rebuild is six months it may hurt. I did some testing at a condo that had the electrical room flood and explode. The building was closed for around six months IIRC due to no elevators, fire alarms or power.

Moving out would entail taking furniture down a lot of stairs.

I don't know how insurance is affected by present house prices, material costs, labour costs and labour shortages.

It will cost more and take longer than expected. When was the last time you looked at your policy numbers?

My current policy is 5M cap for contents plus rebuild. That is millions more than I need. Based on my review, the only time I really have to bend over is water damage up into the basement. The amount paid out for that vs the cost to redo are way out of whack. Bumping up coverage to a reasonable number was a crazy bump in premium. I have had some significant rain events and nothing so far so I am taking my chances on that one.Be very careful of how you spend the insurance money as there is usually a cap. A client had a house fire and it wasn't a total loss but after the smoke in the air cleared the smell of it in the undamaged clothing, carpets and drapes remained.

The restoration company spent a bundle on cleaning those and when the bills were tabulated insurance didn't cover the rest of the rebuild so he was out of pocket.

Then as they tried to use the soft goods the smell of the smoke was still there so they ended up being discarded. Money down the toilet.

Someone else I knew had a house fire and had to move into a hotel during rebuild. The insurer was trying to chisel down the payout by saying the $500? a week hotel food tab should be offset by the $200? a week they normally spent on groceries. He argued they only spent $100 a week. It was a long time ago so numbers are examples.

Check how much alternate accommodation your insurance allows. An agent friend told me typical renters contents insurance only had 15% for accommodation. If there's $10,000 insurance that's $1500 for rent. If the rebuild is six months it may hurt. I did some testing at a condo that had the electrical room flood and explode. The building was closed for around six months IIRC due to no elevators, fire alarms or power.

Moving out would entail taking furniture down a lot of stairs.

I don't know how insurance is affected by present house prices, material costs, labour costs and labour shortages.

It will cost more and take longer than expected. When was the last time you looked at your policy numbers?

A house near me was just listed for double what they purchased it for less than two years ago. The have torn down the decks, added a pool w interlock and cosmetic renovations inside (different, not necessarily better). It will be interesting to see how much they get for it. That seems a hell of a lot like a profitable business not a principal residence.

Last edited:

The house that listed for 1.8M a few blocks away is still up for sale. They ain’t getting it.A house near me was just listed for double what they purchased it for less than two years ago. The have torn down the decks, added a pool w interlock and cosmetic renovations inside (different, not necessarily better). It will be interesting to see how much they get for it.

If it hasn’t sold yet for that price….not going to.

Check out this listing

EDIT to your edit @GreyGhost that’s the problem in my opinion. People using housing to cram as much profit as possible without paying tax on the gains. While I know some here do it professionally and I’m all for it so long as you do it properly. It’s all legal….but CRA doesn’t have the resources or give a **** about catching the illegal flippers.

Agreed. Market is regaining some sanity but now sellers need to decide what's important. Some are stuck on their number (which they may never get), others acknowledge the changing prices and take what they can get and hope that a soft sale price is mirrored by a soft purchase price. That's what we did the last time we moved. Just before foreign buyers tax came in we could have got ~850. When we sold, I thought we should get 750 but the only buyer was at ~675K. Do you wait for your number or jump? That was 2.5 years ago, they should be able to get 1M for it now. Great return for the buyer.The house that listed for 1.8M a few blocks away is still up for sale. They ain’t getting it.

If it hasn’t sold yet for that price….not going to.

On that note, someone that obviously enjoys the pipe has relisted his properties in Aurora. For the past 13 years, whatever the reasonable market price is, he asks for more than double. His current dream is close to 5M for 19 acres of swamp with a really weird house that has been converted into three apartments. It looks like the whole house last rented for $2400. If he was fixated on a number, he could sell now for what he wanted 13 years ago, but he is obviously nuts. It has been listed five times in 13 years without a sale. The closest he got to a reasonable price was 1.5M in 2015 (still crazy) but now believes that close to 5M is the right number with no improvements to the property.

EDIT:

Minor update on the house that they think has doubled in price in less than two years. Another house in the neighbourhood ~30% larger listed for the 100 less and sold in a day for the dreamers asking price. Dreamer has been up for six days. Realistically, I think the dreamer is at least 300 high. Their closest comp sold this spring for 500 less than they are asking. Craziness all around.

Last edited:

D

Deleted member 50930

Guest

Posthaste: You need to plunk down at least $175,000 and 40% of your monthly income to afford a home in these cities

The price surge is forcing one in three Canadian homebuyers to explore alternative options

That article focusses on the flawed (failed?) premise of median income and home ownership. That ship sailed years ago. I'm not saying that's fair, right or good but that is reality. Sadly, in most of southern ontario (and quickly expanding outwards), the bottom 70% or so are probably stuck as renters (barring a substantial external cash influx) with the top 15% owning most of the properties and the chunk in the middle fighting to pay for one dwelling.

Posthaste: You need to plunk down at least $175,000 and 40% of your monthly income to afford a home in these cities

The price surge is forcing one in three Canadian homebuyers to explore alternative optionsfinancialpost.com

I was talking with a lady on the weekend. She owns and lives in a small two bedroom house (well 2+1) with her husband and two kids and the basement rented out. It requires substantial repairs and she is concerned about paying for them. Not a ton of family income (probably close to median?). She owns a condo that is rented, rent covers expenses and pays mortgage and her husband owns a duplex with his father. Given that they own at least three dwellings, I asked her if she realized she was up ~1M in the last year. She hadn't thought about that. She was just looking at cashflow and lack of living space. Now, the paper gains aren't that helpful for her unless she plans on getting rid of a dwelling. Sure, she could probably access the capital in one or more of them, but paying off that loan would add stress to her life (maybe a lot of stress)