Mad Mike

Well-known member

Thank goodness they are looking out for us.

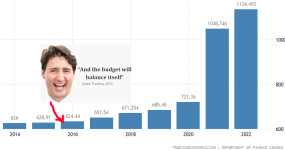

Here's the answer to the question asked to Freeland, the federal portion of debt payments is $44B next year, or approx 10% of all federal spending. Canada has about 18M citizens that are net federal income tax contributors -- their average contribution is approx $200/mo each just to pay the interest on Canada's federal debt.