You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BOC Hits 5%

- Thread starter Mad Mike

- Start date

Damn JT. Look what he's done to Egypt.

The central bank said it had raised the overnight lending rate to 28.25% and its overnight deposit rate to 27.25%, as part of a decision to accelerate monetary tightening and bring down inflation, which rose to record levels last year.

The central bank said it had raised the overnight lending rate to 28.25% and its overnight deposit rate to 27.25%, as part of a decision to accelerate monetary tightening and bring down inflation, which rose to record levels last year.

Mad Mike

Well-known member

I'm guessing no. I think toy prices will continue to fall, but no immediate gush of fire sales.So I can soon get a deal on toys??

You'd think big toys, RVs and bigger boats, would be flooding the post pandemic market, but they are not (yet). I'm guessing they are so far underwater that owners have to keep them. I'll bet there will be a lots of low mileage/hour queens available as the financing terms get near the end, probably 3-4 years out.

Some RV dealers are selling units at auction to try and generate cash flow. New stock units from manufacturers are costing less than last year models and inventory is full. Will be interesting to see how things play out.

New unit orders are not gaining much traction even with the lower costs.

The big distributors are probably ok. The mid and small market dealers could be in trouble.

Same for boats.

Not sure about Powersports.

New unit orders are not gaining much traction even with the lower costs.

The big distributors are probably ok. The mid and small market dealers could be in trouble.

Same for boats.

Not sure about Powersports.

AllistonGT

Well-known member

I'm guessing those are lower end units. I've been watching pricing on upper end B class motorhomes. Not seeing any of those listed in the few auctions I've seen advertised. Went to the RV show last weekend. So much junk being built.Some RV dealers are selling units at auction to try and generate cash flow. New stock units from manufacturers are costing less than last year models and inventory is full. Will be interesting to see how things play out.

New unit orders are not gaining much traction even with the lower costs.

The big distributors are probably ok. The mid and small market dealers could be in trouble.

Same for boats.

Not sure about Powersports.

The last go around had fire sales on big boats.I'm guessing no. I think toy prices will continue to fall, but no immediate gush of fire sales.

You'd think big toys, RVs and bigger boats, would be flooding the post pandemic market, but they are not (yet). I'm guessing they are so far underwater that owners have to keep them. I'll bet there will be a lots of low mileage/hour queens available as the financing terms get near the end, probably 3-4 years out.

$1 million mortgage

$200 K Boat loan on depreciating asset.

$15,000 a year boat insurance and storage.

Dump the boat for $100K and add $100K to the house mortgage if there's room.

You end up with $1.1 million in debt and no $15K a year ownership cost.

It buys some breathing room.

At peak Covid it was hard to find a boat. It may become hard to find one without a For Sale sticker.

Mad Mike

Well-known member

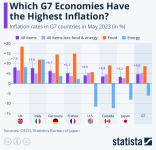

I'm not going with those numbers, they are almost a year old.The G7 and world in general must be pretty ****** with JT and Canada for causing global inflation and then being below average on the inflation front.... /s

View attachment 66426

The most recent Trading Economics numbers

| United Kingdom | 4 |

| Italy | 0.75 |

| Germany | 2.5 |

| France | 2.9 |

| United States | 3.1 |

| Japan | 2.2 |

| Canada | 2.9 |

| Euro Area | 2.6 |

We're still well above the average G7 inflation rate, and we're not running the glide path down fast enough. The Europeans have done pretty well - remember they have one HUGE challenge -- the cost of energy (show in your chart). So considering they pretty much all are at a lower inflation rate than Canada (except the UK). Americans too, considering they managed some impressive wage gains.

If this were a hockey season, Team JT would miss the playoffs.