Mine went down.Auto and motorcycle insurance hasn't been too crazy other than when intact bought out jevco they doubled the rates, but house insurance. i have never had a claim, my rates have doubled even with me lowering coverages.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

200 a month !!! Really?

- Thread starter gcrouse

- Start date

Cialis/ ViagraMine went down.

You're welcome ☺

Sent from my custom Purple Joe Bass mobile on Tapatalk

Any reactions between those and flomax?Cialis/ Viagra You're welcome ☺ Sent from my custom Purple Joe Bass mobile on Tapatalk

Yes.Any reactions between those and flomax?

Pull out.

Sent from my custom Purple Joe Bass mobile on Tapatalk

Unless you're 21 with good credit and can accept bankruptcy then this is horrible advice. The housing bubble that we have now (don't kid yourselves, it is a bubble) is a result of super low interest rates that have done nothing to benefit the public, but have done wonders for the government, builders/renovators and the banks. The only thing lowering interest rates has done is it promoted skyrocketing house prices. If you could afford $1400 per month when the interest rates were 10%, then surprise, you can still only afford $1400 per month when the interest rates are 2%. What happens is that now instead of getting a $200,000 mortgage and paying $1400 a month for, you now have a $400,000 mortgage that you're paying $1400 a month for. And because everyone can afford a larger mortgage with low interest rates, the house prices go up. So you end up with the same house, with the same monthly payments, just with a bigger debt. Oh and when you buy the house, you pay a bigger land transfer tax because it's tied to the cost of the house (+1 gov't), you probably have to pay CMHC because it's actually twice as hard to save for a 20% downpayment on $400k than it is for $200k (+1 banks). Finally, your yearly property taxes are also based on the value of the house, so those go up (+2 gov't). The gov't screwed the general population by lowering interest rates to these levels. The worst part is that everyone welcomed them with open arms because they didn't have the faintest idea that they were getting screwed. As a final fist job from the banks, you're almost guaranteed to own the mortgage longer with lower interest rates because the principle is so much higher. If you're left with $1000 at the end of every month that you can put against your principle, where is it more effective against a $200k principle, or $400k principle?Why is it "best" to pay it off asap? I'll argue that when interest rates are this low, and you're not extremely risk-averse, it's best to borrow MORE - this is especially true for the younger folks who aren't yet tied down with serious obligations like raising kids etc. The bank is almost handing you free money - if you wanna get rich, you'll take it and run. Like it or not, real estate has been very lucrative for folks. The bank will lend you money @2% to buy a house. Inflation (CPI) was upwards of 1.6% just 2 months ago.

If you still think real estate is a great investment and these prices are going to keep climbing, look to the south, they thought the same thing in 2007. We're in worse shape financially than they were then. 1+1 isn't going to equal 'fish' forever (<- The Big Short reference).

Last I checked , banks are not handing out subprime loans to anyone who knocks on the door.

So far, real estate has been a great investment. You can complain about it, or you can join the fun? The doom and gloom has been constant for a decade now. I have friends who gave me the same shpiel at 5% and at 4 and at 3. This bubble was supposed to pop 10 times by now..

I'm willing to bet MY money that it won't pop next year, and I'm looking to make 15% on the bank's 600k loan. If it does pop, then so be it. Never gonna get anywhere in life without taking some risks - and to me this is a pretty low risk proposition.

So far, real estate has been a great investment. You can complain about it, or you can join the fun? The doom and gloom has been constant for a decade now. I have friends who gave me the same shpiel at 5% and at 4 and at 3. This bubble was supposed to pop 10 times by now..

I'm willing to bet MY money that it won't pop next year, and I'm looking to make 15% on the bank's 600k loan. If it does pop, then so be it. Never gonna get anywhere in life without taking some risks - and to me this is a pretty low risk proposition.

Cialis/ Viagra

You're welcome ☺<-----

Sent from my custom Purple Joe Bass mobile on Tapatalk

A little head. Thanks.

-D-

Banned

@Renboy

I was just thinking the same thing and mentioned that to a friend yesterday in regards to the now 15% tax in BC.

Govt stepped in AFTER they got the rewards, they did not protect the locals, they EXPLOITED them.

Govt get all the fees, higher taxes and the higher the price of the property then the better the Govt does and will keep doing.

Nobody is asking...how the hell is the average kid going to afford a small house here in 10-15 years...unless by house you live in a condo for life.

Like they say...what goes up...interest rates move up 1% and this will get crazy.

I was just thinking the same thing and mentioned that to a friend yesterday in regards to the now 15% tax in BC.

Govt stepped in AFTER they got the rewards, they did not protect the locals, they EXPLOITED them.

Govt get all the fees, higher taxes and the higher the price of the property then the better the Govt does and will keep doing.

Nobody is asking...how the hell is the average kid going to afford a small house here in 10-15 years...unless by house you live in a condo for life.

Like they say...what goes up...interest rates move up 1% and this will get crazy.

I'm not one for conspiracy theories but not only does the .gov cash in as described above but this could also be a way to social engineer people into apartment/condo living to save green space. I"m just dying to see how the .gov will stick handle us out of cars. Probably start with a downtown tax and work outwards.

It would take extraordinary national and/or global events to see a sudden spike in interest rates. If it happens , were all doomed...whether you own a house or not. It is for this reason the gov will be extremely careful and methodical in how and when they choose to start raising rates. The idea that we'll wake up tomorrow to 16% interest is laughable.@Renboy

I was just thinking the same thing and mentioned that to a friend yesterday in regards to the now 15% tax in BC.

Govt stepped in AFTER they got the rewards, they did not protect the locals, they EXPLOITED them.

Govt get all the fees, higher taxes and the higher the price of the property then the better the Govt does and will keep doing.

Nobody is asking...how the hell is the average kid going to afford a small house here in 10-15 years...unless by house you live in a condo for life.

Like they say...what goes up...interest rates move up 1% and this will get crazy.

Going from 2 to 4% on a 500k mortgage is about $500/Mo. If that's a crushing thought, you shouldn't be borrowing half a mil in the first place.

Interest rates went from 7 to 8 to 12 to 21% over fifteen years. We are at low rates now.

If you can make 15% and pay it off if the rates start to climb, or are willing to take the risk, go for it.

If you're amortizing over 30 years, then account for rate changes over those years.

The last 100 thousand seems easy compared to the first.

If you can make 15% and pay it off if the rates start to climb, or are willing to take the risk, go for it.

If you're amortizing over 30 years, then account for rate changes over those years.

The last 100 thousand seems easy compared to the first.

It would take extraordinary national and/or global events to see a sudden spike in interest rates. If it happens , were all doomed...whether you own a house or not. It is for this reason the gov will be extremely careful and methodical in how and when they choose to start raising rates. The idea that we'll wake up tomorrow to 16% interest is laughable.

Going from 2 to 4% on a 500k mortgage is about $500/Mo. If that's a crushing thought, you shouldn't be borrowing half a mil in the first place.

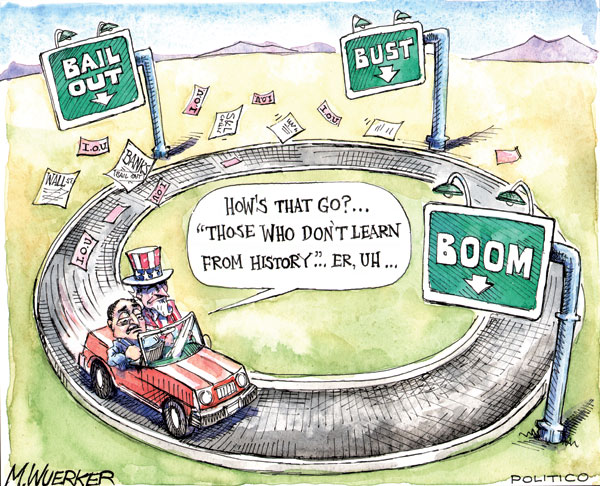

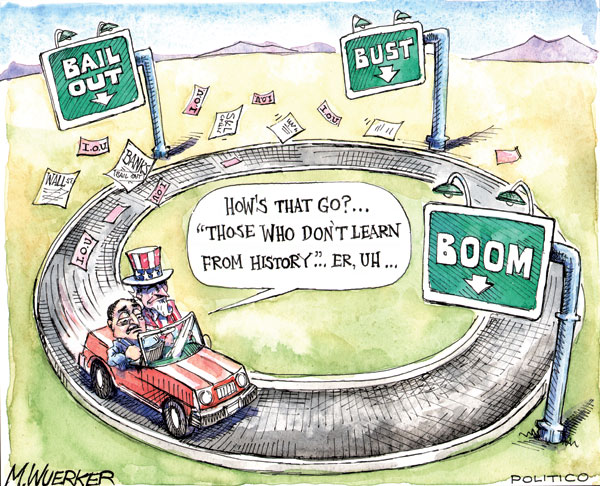

Monetary policy has been manipulated endlessly for nefarious purposes; history has proven this time and again. It's not a matter of if, but when.

Round and round we go.

Captain Obvious?Monetary policy has been manipulated endlessly for nefarious purposes; history has proven this time and again. It's not a matter of if, but when.

Round and round we go.

The doom and gloomers will EVENTUALLY be right, just like a broken clock is right twice a day. This isn't the argument.

My point is that the foreseeable future looks good. Interest rates won't skyrocket and our province population growth forecasts are strong. I've taken advantage of this while others have waited for the bust for years now. So I'll say again if you're not completely averse to risk, now is an EXCELLENT time to borrow money from the banks.

Sent from my Nexus 4 using Tapatalk

I'm not interested in paying anything off besides my own house, which isn't an investment but a roof over my head. I'm willing to borrow for other property and I feel VERY strongly about this market staying on trajectory for another year.Interest rates went from 7 to 8 to 12 to 21% over fifteen years. We are at low rates now.

If you can make 15% and pay it off if the rates start to climb, or are willing to take the risk, go for it.

If you're amortizing over 30 years, then account for rate changes over those years.

The last 100 thousand seems easy compared to the first.

Sent from my Nexus 4 using Tapatalk

Captain Obvious?

The doom and gloomers will EVENTUALLY be right, just like a broken clock is right twice a day. This isn't the argument.

My point is that the foreseeable future looks good. Interest rates won't skyrocket and our province population growth forecasts are strong. I've taken advantage of this while others have waited for the bust for years now. So I'll say again if you're not completely averse to risk, now is an EXCELLENT time to borrow money from the banks.

I actually don't disagree; in fact, I'm actively searching for the right income property to add to my debt list

But, there is always risk, and on the global financial stage, the IMF/China/SDR bonds could be a sign of global bust ahead (if you believe in problem reaction solution) ... but as you say, should it happen, so be it. Can't live in fear of what ifs and could bes

Bank money has never been cheaper, and I would not hesitate at all on the right property as an investment. And i would pay out any mortgage ASAP. Borrowed money is.... borrowed money. Dragging it out is never really a great idea.

Where I see the future problems , and its been pointed out in the=is thread many times, good debt/bad debt, and there are too many people levered to the teats on 'investment property'.

Hopefully we will never see it here, some US areas had properties drop to 40% of the value of the peak sell price 4-5 years earlier.

Where I see the future problems , and its been pointed out in the=is thread many times, good debt/bad debt, and there are too many people levered to the teats on 'investment property'.

Hopefully we will never see it here, some US areas had properties drop to 40% of the value of the peak sell price 4-5 years earlier.

-D-

Banned

Hi Remember me? The OP? LOL my question was im shocked people are that close to the edge financially. Carry on !!! Im not really seeing that here from most ....

Why would ppl admit that to you? lol

Also...you know the $amount of debt...Do you think that debt is racked up by 'poor' people living in trailer parks driving a $500 car?

-D-

Banned

It would take extraordinary national and/or global events to see a sudden spike in interest rates. If it happens , were all doomed...whether you own a house or not. It is for this reason the gov will be extremely careful and methodical in how and when they choose to start raising rates. The idea that we'll wake up tomorrow to 16% interest is laughable.

Going from 2 to 4% on a 500k mortgage is about $500/Mo. If that's a crushing thought, you shouldn't be borrowing half a mil in the first place.

I said 1%...you are going to the extreme off the start...click a link on a mortgage calc and use 400k (typical 1 bedroom condo price)...move it up 1% and see how that looks...we are not talking about special assessments etc...

Just saying there are a lot of ppl just skimming by with those condos...also even as the investor that rent them out...move it 1% and rent goes up.

-D-

Banned

I'm not one for conspiracy theories but not only does the .gov cash in as described above but this could also be a way to social engineer people into apartment/condo living to save green space. I"m just dying to see how the .gov will stick handle us out of cars. Probably start with a downtown tax and work outwards.

I think China is building those super buildings where everything is closed in...schools, parks, restaurants etc...

I was watching a program and super high skyscrapers and they were showing how it's a vertical village/city.

The thought that came to me was how do these ppl meet other ppl...you pretty much did not need to leave your large box.