Their customer service has been responsive so far, touchwood. But I have not used them much - maybe twice. The invoice does show taxes collected in the US.I found Crossboarder pickups customer service less then stellar. Basically stonewalling you with no real answers, which is why I switched over to Shipsy.

Technically if the US company collected the CBSA Duties and Taxes you souldn't have to pay it again. It should be on your invoice, and if you shared that with Crossboarder they shouldn't have a reason to collect them again.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Rape Fees

- Thread starter -Maverick-

- Start date

Relax

Well-known member

I ordered a new PC3 from a supplier in the US and paid taxes there, Crossborder pickups is charging taxes again on the item on top of what I paid in the US. When asked they mentioned that it is applicable as CBSA doesn't care for what taxes US charges. Is this true?

I guess my only option is to pay the taxes and hope that there are no other charges.

It's important to understand WHICH taxes you paid to your supplier. Since you're using Crossborder Pickups, the package wasn't shipped directly to Canada from the seller, so they wouldn't have been collecting any Canadian taxes or duties. Out-of-state online/mail orders are now being taxed based on the destination state's sales tax, depending on certain factors such as whether the company normally conducts business in that state. For example, although there is no physical Amazon store in NY, they still charge you NY state sales tax on all orders delivered there. And if this is the tax you paid on your order, that has nothing to do with the Canada (or Crossborder Pickups for that matter). The CBSA will simply tax apply HST to the total value of your package which includes any taxes and shipping you paid.

sburns

Well-known member

Yeah I recently noticed US state taxes on online orders, which were not there before.It's important to understand WHICH taxes you paid to your supplier. Since you're using Crossborder Pickups, the package wasn't shipped directly to Canada from the seller, so they wouldn't have been collecting any Canadian taxes or duties. Out-of-state online/mail orders are now being taxed based on the destination state's sales tax, depending on certain factors such as whether the company normally conducts business in that state. For example, although there is no physical Amazon store in NY, they still charge you NY state sales tax on all orders delivered there. And if this is the tax you paid on your order, that has nothing to do with the Canada (or Crossborder Pickups for that matter). The CBSA will simply tax apply HST to the total value of your package which includes any taxes and shipping you paid.

The item is coming from Cali. I think I was taxed around 8% (USD 18 for a USD 225 item) which is probably the state tax. I bought this item off ebay so it's not clear but my best guess is that it's the state tax. So I got to suck it up and pay another 13% Ontario HST.It's important to understand WHICH taxes you paid to your supplier. Since you're using Crossborder Pickups, the package wasn't shipped directly to Canada from the seller, so they wouldn't have been collecting any Canadian taxes or duties. Out-of-state online/mail orders are now being taxed based on the destination state's sales tax, depending on certain factors such as whether the company normally conducts business in that state. For example, although there is no physical Amazon store in NY, they still charge you NY state sales tax on all orders delivered there. And if this is the tax you paid on your order, that has nothing to do with the Canada (or Crossborder Pickups for that matter). The CBSA will simply tax apply HST to the total value of your package which includes any taxes and shipping you paid.

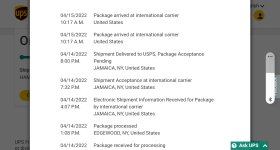

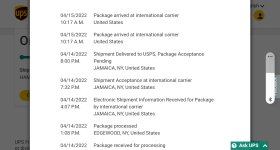

I ordered from the usa the other day, making sure that usps would be the carrier. I was ups raped once in the past.

When I opened my tracking thing, it was ups tracking. My heart sank. Now I'm expecting fees, and fees, and more fees.

When I looked today, it notes that ups delivered it to usps in ny state. My heart warmed up.

I've never seen this before. (Still waiting for delivery).

When I opened my tracking thing, it was ups tracking. My heart sank. Now I'm expecting fees, and fees, and more fees.

When I looked today, it notes that ups delivered it to usps in ny state. My heart warmed up.

I've never seen this before. (Still waiting for delivery).

Mad Mike

Well-known member

It's not uncommon for carriers and shippers to use other carriers for cross border shipping.

Most high volume shippers have access to line haul services that consolidate goods for cross border customers. For example, a widget store that normally uses UPS for domestic US deliveries might consolidate Canadian shipments for crossing the border. This is very common for Canadian ecommerce companies as a large percentage of their customers are in the USA. In our business, we consolidate all package shipments, import the whole shebang into the US, then drop packages at UPS, Fedex, and USPS in Buffalo for the final delivery. The only package carrier I know that does this from the US to Canada is Purolator. UPS and Fedex will carry consolidated shipments to USPS terminals, UPS then hauls to Canada Post who takes it for final delivery.

Most high volume shippers have access to line haul services that consolidate goods for cross border customers. For example, a widget store that normally uses UPS for domestic US deliveries might consolidate Canadian shipments for crossing the border. This is very common for Canadian ecommerce companies as a large percentage of their customers are in the USA. In our business, we consolidate all package shipments, import the whole shebang into the US, then drop packages at UPS, Fedex, and USPS in Buffalo for the final delivery. The only package carrier I know that does this from the US to Canada is Purolator. UPS and Fedex will carry consolidated shipments to USPS terminals, UPS then hauls to Canada Post who takes it for final delivery.