Pool in the sky, water towerLiving in the hills just install the pool above the house up the hill... siphon sprinklers. /s

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

COVID and the housing market

- Thread starter mimico_polak

- Start date

A friend over drained their vinyl pool and it sagged like a 70 year old boob.California is allowed to use any available water source to fight fires. That could include your pool. I'm not sure if you are allowed to put something over or near your pool to discourage them from taking a few thousand liters a scoop as you want it for your roof sprinkler. A roof sprinkler is 20-50 gpm. My pool is relatively small and it's 13000 gallons (but if you pump it empty, it may pop up like a boat). Even at 100 gpm and leaving some water in the pool, that is days of sprinkler use. You normally need far less than that.

A decent redundant system would cost tens of thousands (two ICE pumps in parallel contained within a structure that allows air flow but minimizes chance of fire). Starting it at the right time and getting away is not simple. I know some municipalities that encourage roof sprinklers have you set everything up and leave the open frame honda pump sitting on your front lawn and fire fighters start all the pumps as the fire approaches. It takes some effort from them but it also helps them do their job.

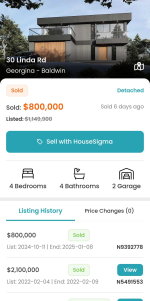

Started construction in 2021. Predicted completion 2022. Tried to sell for 2.9 in late 2021. Sold for 2.1 in early 2022. Still not done (house wrap exposed for maybe four years). Buyer to inspect and complete due diligence. I suspect this is a dead man standing. What's the lot worth minus demo costs? Maybe 800? It's a two acre lot.Partially finished house sold in Georgina...

View attachment 71978

From Google Maps...

View attachment 71979

I wonder if this is orginal owner and it failed to close as it was never finished or if ownership transferred and builder was supposed to finish it in which case it will be a complete cluster. In either case I'd be worried about construction liens.

Interesting. That could work for both sides. The biggest obstacle is the original buyer admitting to themselves that the 20% is gone and they need to work on a stop-loss asap. Very few understand that their loss isn't limited to the deposit and even fewer are willing to admit they lost money on something they never even actually owned.Nothing to see here folks...

View attachment 72138

I'm sure we'll see more and more of these types of requests. And losing a 20% deposit is def a scenario many buyers didn't expect when they dropped their hard earned HELOC.

Renting, first time buyers go back to zero assets after bankruptcy. People moving up go from home owners to renters after bankruptcy.Interesting. That could work for both sides. The biggest obstacle is the original buyer admitting to themselves that the 20% is gone and they need to work on a stop-loss asap. Very few understand that their loss isn't limited to the deposit and even fewer are willing to admit they lost money on something they never even actually owned.

Maybe, maybe not. The move up buyers were planning on adding hundreds of thousands of debt to move up (or acquire a rental property). Many could financially survive but they end up with added debt on their original property. Ouch. But you have a place to live and less debt than you planned on taking on. It sucks to return to 25+ years on your mortgage after paying for a decade though.Renting, first time buyers go back to zero assets after bankruptcy. People moving up go from home owners to renters after bankruptcy.

I know someone that went through it in an earlier downturn. He signed for a new build and was going to wait six months before selling his to take advantage of the gain in his old place. The gain went south and he put both options up for sale.Maybe, maybe not. The move up buyers were planning on adding hundreds of thousands of debt to move up (or acquire a rental property). Many could financially survive but they end up with added debt on their original property. Ouch. But you have a place to live and less debt than you planned on taking on. It sucks to return to 25+ years on your mortgage after paying for a decade though.

He ended up in the new build with a much larger than expected mortgage but he had something to show for the outlay.

Ugh…the house we really like is going up for sale soon (1-3 months). Last I talked to the bank selling ours and buying that house would be an ADDITIONAL 3300/month atop our current mortgage.

Hopefully things will change for the better with recent rate drops since then, but I’m almost tempted to ask the seller for a vendor take back mortgage instead of going traditional route.

Thoughts on vendor take back?

Hopefully things will change for the better with recent rate drops since then, but I’m almost tempted to ask the seller for a vendor take back mortgage instead of going traditional route.

Thoughts on vendor take back?

ifiddles

Well-known member

Why? What's wrong with your house? Why would you want to get into that kind of situation at your age/stage in life? Why not just enjoy what you have (improve it if need be) and spend that extra money on experiences for/with your family? I don't understand the never-ending cycle of upgrading (homes, cars, bikes etc).Ugh…the house we really like is going up for sale soon (1-3 months). Last I talked to the bank selling ours and buying that house would be an ADDITIONAL 3300/month atop our current mortgage.

Hopefully things will change for the better with recent rate drops since then, but I’m almost tempted to ask the seller for a vendor take back mortgage instead of going traditional route.

Thoughts on vendor take back?

Fair.Why? What's wrong with your house? Why would you want to get into that kind of situation at your age/stage in life? Why not just enjoy what you have (improve it if need be) and spend that extra money on experiences for/with your family? I don't understand the never-ending cycle of upgrading (homes, cars, bikes etc).

Our house is good but their house has more space, double height garage, beautiful pool, and a full basement where ours is lacking.

With 3 kids, MIL, and us the house feels ‘smallish’ but doable.

If the numbers work…we’ll do it. If not, we stick with what we have.

Technically I can add space to our house, build a pool, and have the same…

But their house is just much more functional out of the box.

It sounds like turning your house into that house would cost a fortune and take a long time.Fair.

Our house is good but their house has more space, double height garage, beautiful pool, and a full basement where ours is lacking.

With 3 kids, MIL, and us the house feels ‘smallish’ but doable.

If the numbers work…we’ll do it. If not, we stick with what we have.

Technically I can add space to our house, build a pool, and have the same…

But their house is just much more functional out of the box.

MIL isn't going to be there forever but three kids will be getting bigger fast.

There is no way I could take on thousands more a month no matter how awesome the house was. I (and most of us) are grossly overweight on residential housing as part of our net worth. While that makes sense to a point given the tax treatment, if you run out of cash flow, the whole thing collapses.

I take full blame for showing you my basement...a full basement where ours is lacking.

That is one mighty nicely sized basement…so many possibilities!I take full blame for showing you my basement...

One of my neighbours apparently built himself a storage space under half his house as a DIY….im not that brave.

First you call in a Polish guy named Danny the tunnel rat , who looks a lot like Charles Bronson, then every body puts some gravel in thier pant legs and wanders down the street dumping strategically. Oh wait , wrong movie .

Sent from my iPhone using GTAMotorcycle.com

Sent from my iPhone using GTAMotorcycle.com

Visited a buddy's friend in London who had dug a tunnel from his basement to his barn/garage. Crazy is as crazy does.....That is one mighty nicely sized basement…so many possibilities!

One of my neighbours apparently built himself a storage space under half his house as a DIY….im not that brave.