One house near me just listed for almost 1M over the comps. It's a little bigger but holy crap. We'll see how it plays out. Sometimes the ones that seem high sell faster and for far more money than the ones priced in line with comps.Had 2 realtors look at moms house this week. 3000 sq feet 2 car garage 4 car driveway quiet cul-de-sac backs on to a ravine In oakville. Smaller ones 1.5 in February now telling us list for 1.375 hope for 1.3.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

COVID and the housing market

- Thread starter mimico_polak

- Start date

I’m almost tempted to look a bit further out from where we are. We may still get a 1.4-1.5 sale….and Oakville sounds like a good alternative for a larger lot with a bigger house.

Wife will have something to do while I play video games.

Wife will have something to do while I play video games.

GVH's moms house sounds pretty nice. If you can reduce your mortgage while getting bigger and still stay in a nice neighbourhood, I'd call that a win.I’m almost tempted to look a bit further out from where we are. We may still get a 1.4-1.5 sale….and Oakville sounds like a good alternative for a larger lot with a bigger house.

Wife will have something to do while I play video games.

Neighbor's houses for sale 3.2 million 680 ft² but you get 88 acres with itI’m almost tempted to look a bit further out from where we are. We may still get a 1.4-1.5 sale….and Oakville sounds like a good alternative for a larger lot with a bigger house.

Wife will have something to do while I play video games.

Sent from the future

Those built in porta potties are only to make booze legal.You mean like 95% of campers and boats where the shitter is beside your head when laying down , possible separation by 3/8 particle board with vinyl overlay?

Sent from my iPhone using GTAMotorcycle.com

It's sad when 1.23 seems cheap for a gta sfh.House on my street was asking $1.25m, sold quickly for $1.23m.

It’s still a crap shoot , and they are worth what somebody will pay . The towns on my street peaked at 1.45 , now listing in the 1.25 1.3 , nice house across the street 2,600 sq with pool went for 2.4 . Guy relocated from Vancouver and said , it’s pretty good compared to Van. Um Oky doky LOL

Sent from my iPhone using GTAMotorcycle.com

Sent from my iPhone using GTAMotorcycle.com

Sochi

Well-known member

Source:

BNN Bloomberg - Canada Business News, TSX Today, Oil and Energy Prices

Get the latest Canadian business news, including TSX updates, changes to oil and energy prices, and Bank of Canada coverage. Explore stock market investing and get expert financial insights on investment portfolio strategies.

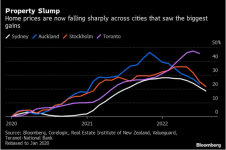

Averages don't mean much. The key is to look at many individual houses that turned over a few times recently. As market changes the types of houses available for sale (and more importantly selling) changes. The ones that I have seen outside Barrie that resell in six to twelve months are up ~$100k. Close to break even when costs are considered.View attachment 57471

Source:

BNN Bloomberg - Canada Business News, TSX Today, Oil and Energy Prices

Get the latest Canadian business news, including TSX updates, changes to oil and energy prices, and Bank of Canada coverage. Explore stock market investing and get expert financial insights on investment portfolio strategies.www.bnnbloomberg.ca

Sochi

Well-known member

Averages don't mean much. The key is to look at many individual houses that turned over a few times recently. As market changes the types of houses available for sale (and more importantly selling) changes. The ones that I have seen outside Barrie that resell in six to twelve months are up ~$100k. Close to break even when costs are considered.

I just think that the "adjustment" hasn't even started yet... I'd give it a year to see where we end up...

Wrong or right - I'll find this very post in one year and post the update

Mad Mike

Well-known member

I can't believe rents in Oakville/Burlington -- I'm trying to help an older couple relo/downsize to a rental bungalow in Burlington/Aldershot area. 2BR bungalows starting at $3750/mo?It’s still a crap shoot , and they are worth what somebody will pay . The towns on my street peaked at 1.45 , now listing in the 1.25 1.3 , nice house across the street 2,600 sq with pool went for 2.4 . Guy relocated from Vancouver and said , it’s pretty good compared to Van. Um Oky doky LOL

Sent from my iPhone using GTAMotorcycle.com

Im a bit shocked by Oak/Burl rents as well , Aldershot for a long time was a 'deal' , but it has become a cool alternative to Burlington central , like happened to Bronte instead of Oakville.

Downsizing and relocating as a renter is pretty hard unless your willing to comprimise on your address. And right now I think its outside prime corridor of Mississauga to Aldershot. Go train access spiked Aldershot and the North end of Hamilton

Downsizing and relocating as a renter is pretty hard unless your willing to comprimise on your address. And right now I think its outside prime corridor of Mississauga to Aldershot. Go train access spiked Aldershot and the North end of Hamilton

Does a senior pay $4K-$5K in rent after selling or hang in at the paid for home watching the value drop about the same? I've got a friend in that position. He's totally ignoring estate planning as well.Im a bit shocked by Oak/Burl rents as well , Aldershot for a long time was a 'deal' , but it has become a cool alternative to Burlington central , like happened to Bronte instead of Oakville.

Downsizing and relocating as a renter is pretty hard unless your willing to comprimise on your address. And right now I think its outside prime corridor of Mississauga to Aldershot. Go train access spiked Aldershot and the North end of Hamilton

Wife and I decided to move in 2.5 years. Why 2.5 years you ask, well that is when the lease is up on the business space.

Company has agreed to moving to where I go, If I find a suitable location. as we only require 1500+ Sqft I am hoping to find something in a smaller town in Ontario or perhaps even another province.. I will admit, I kind of like having some potential options for the future..

Company has agreed to moving to where I go, If I find a suitable location. as we only require 1500+ Sqft I am hoping to find something in a smaller town in Ontario or perhaps even another province.. I will admit, I kind of like having some potential options for the future..

you hang in and watch the value drop, because it ALWAYS comes back, we have 100yrs of historic data and if you keep your pants on , it come back. Or you bail, pay 3-5k per monthb in rent , which is gone, and when the rebound happens , you are double screwed.

Sorry people that refuse to aknowledge estate planning , plan for a future in any capacity are not worthy of being in a conversation with grown ups

Sorry people that refuse to aknowledge estate planning , plan for a future in any capacity are not worthy of being in a conversation with grown ups

Mad Mike

Well-known member

I'm with you, real estate is a long-term thing with substantial transaction costs. To downsize from a $1.5m home to a $1m home can reduce one's equity by $80 to $110K ---> commissions, legal fees, taxes, and moving expenses. Going to a rental would still cost $65-80K.you hang in and watch the value drop, because it ALWAYS comes back, we have 100yrs of historic data and if you keep your pants on , it come back. Or you bail, pay 3-5k per monthb in rent , which is gone, and when the rebound happens , you are double screwed.

Sorry people that refuse to aknowledge estate planning , plan for a future in any capacity are not worthy of being in a conversation with grown ups

If you're happy where you are, then I'd stay and ride out the correction.

I'm guessing skyrocketing rents are a result of deflating home values, owners need their asset to work, I suspect it's a switch to generating rents as opposed to growing equity.

This is one to watch.

An example of location, location, location that would have been jumped on by a builder six months ago. The house is not in bad shape other than granny to the max, but in the end it is a two bedroom bungalow tear-down with likely older owners timing out....on a 42X144 lot--asking $2M at the moment.

An example of location, location, location that would have been jumped on by a builder six months ago. The house is not in bad shape other than granny to the max, but in the end it is a two bedroom bungalow tear-down with likely older owners timing out....on a 42X144 lot--asking $2M at the moment.

Last edited:

"Lots Of Potential Future Upside For Those Who Want To Build A Luxury Home On This Coveted Street Boasting Many Luxurious $3-4 Million ++ Homes" Hahaha. The neighbour (167) sold the old house for 1.3 in 2017 and built a 4700 sq ft house that sold in 2019 for 3M. Doing the same to this lot would be 4700*~400/sq ft=1.9M for the house alone. Add in the 2M for the lot and you have paid 4M for a house that might be worth 4M. Not a lot of upside there (sure house prices may continue to rise but construction could easily cost much more). Add in the interest rate escalation and unless people are sitting on many millions in uninvested assets it would be tough to swing. On the flipside, any money spent to renovate the current house will be lit on fire. It will not effect the resale value at all. Oct 2021 a 4 bed 2 storey a block away went for 2.3 and looked like a nice place for a family to live as is. I suspect the number for this house will be closer to 1.5. Sure the person buying it could afford to pay more but they don't want to. They got rich by putting the screws to others not by being generous.This is one to watch.

An example of location, location, location that would have been jumped on by a builder six months ago. The house is not in bad shape other than granny to the max, but in the end it is a two bedroom bungalow tear-down with likely older owners timing out....on a 42X144 lot--asking $2M at the moment.

It is a nice enough house and lot but I think they may have trouble getting 2M (but I have been wrong many times).