IIRC it was similar in Calgary when oil went south in the 1980's.My understanding here, and I could be off... Bank forecloses (owner stopped paying/default), bank tries to sell the property (power of sale) for what they can. If it sells for more than they are owed (I am sure there are fees of course...) they give the delta back to the previous owner, if less the previous owner is on the hook but at that point they have likely declared bankruptcy so the bank is screwed. Of course why would the bank try hard to maximize value (over what is owing) in the sale unless it will sell for less than they are owed. If the property was worth well over market value a smart person would sell instead of defaulting....

On a side note... During the US financial crisis some banks were paying extra cash to the underwater defaulters to not trash the place to protect value. Until the bank takes possession it is your house and you can do whatever (within reason)... it is not like the person did not know they were losing the house. So they were trashing the place or smart ones were selling as much off as they can (cabinets. appliances, copper....) and when the bank took possession it was at a big loss due to the damage.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

COVID and the housing market

- Thread starter mimico_polak

- Start date

Mad Mike

Well-known member

Canadian Banks are ok with this, in fact it’s a payday for them. Most of their risk is insured.Collapsing housing kicks banks in the nuts and on a much smaller scale the developers will be very upset.

Banks love volatility, when any market is going wild, whether up or down, banks have the resources to reap incredible profits during turmoil. Just look at the last 2 years.

During real estate crashes banks increase lending margins, tighten credit availability, and buy a lot of discounted debt from small lenders.

cockroaches could learn a thing or two about surviving and thriving from Canadian banks.

So the bank passes the hit onto an insurer. If the insurer is an insurance company they increase the prices on their other products to make up the loss.Canadian Banks are ok with this, in fact it’s a payday for them. Most of their risk is insured.

Banks love volatility, when any market is going wild, whether up or down, banks have the resources to reap incredible profits during turmoil. Just look at the last 2 years.

During real estate crashes banks increase lending margins, tighten credit availability, and buy a lot of discounted debt from small lenders.

cockroaches could learn a thing or two about surviving and thriving from Canadian banks.

BTW. I expect to see life insurance policies to have some fine print added to cover their arses re epidemics, failure to mitigate (Vaccinate) etc

Many of the banks are insured by us. Hooray. More governments bailouts to protect big money paid for by taxpayers.So the bank passes the hit onto an insurer. If the insurer is an insurance company they increase the prices on their other products to make up the loss.

BTW. I expect to see life insurance policies to have some fine print added to cover their arses re epidemics, failure to mitigate (Vaccinate) etc

The good old CDIC, Canadian Deposit Insurance Corporation. Guaranteeing up to $100,000 per account in case the bank fails. Note the Canadian government owns the Corporation but as it is a corporation, the owner doesn't have to cover its debts if it fails. If there is a massive bank meltdown the CIDC can't cover it all and the owner doesn't have to cough up for the shortfall.Many of the banks are insured by us. Hooray. More governments bailouts to protect big money paid for by taxpayers.

CIDC invests the money and if investments fail at the same time there will be another toilet paper shortage.

Older than most here, I grew up thinking Canada would stand on guard for me as well. That has changed. If you look at the gist of this thread, it come out that Canada has allowed big money and foreign influence to wipe out, in one generation, the concept of being rewarded for hard work and diligence.

D

Deleted member 50930

Guest

^

Loyalty, hard work and diligence don't mean much now ....

Loyalty, hard work and diligence don't mean much now ....

I was more referring to CMHC and banks offering lower rates if you have less equity as they can't possibly lose money as gov't (ie. taxpayers) will foot the bill.The good old CDIC, Canadian Deposit Insurance Corporation. Guaranteeing up to $100,000 per account in case the bank fails. Note the Canadian government owns the Corporation but as it is a corporation, the owner doesn't have to cover its debts if it fails. If there is a massive bank meltdown the CIDC can't cover it all and the owner doesn't have to cough up for the shortfall.

CIDC invests the money and if investments fail at the same time there will be another toilet paper shortage.

Older than most here, I grew up thinking Canada would stand on guard for me as well. That has changed. If you look at the gist of this thread, it come out that Canada has allowed big money and foreign influence to wipe out, in one generation, the concept of being rewarded for hard work and diligence.

D

Deleted member 50930

Guest

That goes back to my argument of smaller dwellings to allow cheaper rent. I never rented anywhere with more than one bathroom. My first house would only have had one but my wife dug her heels in at 1.5 minimum so that's what we got.

Last edited:

D

Deleted member 50930

Guest

That goes back to my argument of smaller dwellings to allow cheaper rent. I never rented anywhere with more than one bathroom. My first house would only have had one but my wife did her heels in at 1.5 minimum so that's what we got.

I'm trying to see if this makes sense but the numbers don't work in my favour. I'm only saving ~$2,000/year and I am downgrading into a shoe-sized apartment. $2,000/year extra for double the space and some freedom for wfh wifey is worth it???

Just eat out less, go on less trips etc and there is the $2,000.00/year ???

I'm trying to see if this makes sense but the numbers don't work in my favour. I'm only saving ~$2,000/year and I am downgrading into a shoe-sized apartment. $2,000/year extra for double the space and some freedom for wfh wifey is worth it???

Just eat out less, go on less trips etc and there is the $2,000.00/year ???

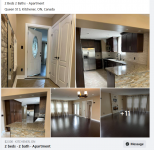

Are you talking about the 2bed2bath? Cause that is anything but a shoe-sized apartment.

You should see the studios and 1beds in most of the GTA. I have closets bigger than some.

D

Deleted member 50930

Guest

Are you talking about the 2bed2bath? Cause that is anything but a shoe-sized apartment.

You should see the studios and 1beds in most of the GTA. I have closets bigger than some.

Decided to stay in KW so I'm looking for 2 bed / 1 bath or 1 bedroom apartments in KW

Currently, I am paying under $1,800 for a huge basement apartment (> 1,300 sq ft) with 3 parking spots, in-suite laundry and some other nice stuff.

edit

Any landlords here? I'll pay $1,000 for 1 bed/1 bath with 2 parking spots ^_^

Last edited by a moderator:

Our last tenant before we sold rented a unit for $1625/month + hydr Lakeshore and Islington.Decided to stay in KW so I'm looking for 2 bed / 1 bath or 1 bedroom apartments in KW

Currently, I am paying under $1,800 for a huge basement apartment (> 1,300 sq ft) with 3 parking spots, in-suite laundry and some other nice stuff.

edit

Any landlords here? I'll pay $1,000 for 1 bed/1 bath with 2 parking spots ^_^

1+1 but we advertised it as 2 bedroom (600sqft) with 1 parking spot.

and I’m an idiot for renting out the place 2 years prior for 1250/month. **** if I was more in line with rents I would’ve been way ahead but NOOOOOOOOOOO I wanted to be ‘nice’ to my tenants. LoL

D

Deleted member 50930

Guest

^

Get a rental already!!

Get a rental already!!

Trust me I want to and am looking into it. But 3 plex units are going for 1.5M….the rents don’t cover the mortgage.^

Get a rental already!!

EDIT: @george__ we had a few tenants that lived far away (Collingwood / Peterborough) and they would live in their units Monday to Friday and then back home to their families for the weekend. Difficult on the family but the time/cost of commuting made it worth it for them. Just a thought.

EDIT2: a few rooms available near UTM for 500-700/month. Your gas bill would thank you and it’d be a wash.

Last edited:

D

Deleted member 50930

Guest

Trust me I want to and am looking into it. But 3 plex units are going for 1.5M….the rents don’t cover the mortgage.

EDIT: @george__ we had a few tenants that lived far away (Collingwood / Peterborough) and they would live in their units Monday to Friday and then back home to their families for the weekend. Difficult on the family but the time/cost of commuting made it worth it for them. Just a thought.

EDIT2: a few rooms available near UTM for 500-700/month. Your gas bill would thank you and it’d be a wash.

Yup that's exactly what I plan to do in the winter.

Rent a room for $500 and then weekends go back to KW... I found a decent landlord but we are still ironing out the details ^_^

D

Deleted member 50930

Guest

Well technically they say visitors have to arrive after midnight. That's not a big problem as it is always after midnight.

D

Deleted member 50930

Guest

Well technically they say visitors have to arrive after midnight. That's not a big problem as it is always after midnight.

I think they are new landlords and dont understand the law...

True. So bring visitors at 11:59pm lolI think they are new landlords and dont understand the law...

Seriously new landlords can be horrible because they expect you to live like them as they’re the owners and want to protect their investment.

Im also pretty sure they can’t have diff rental rates for a single or double occupancy…doesn’t work like that last time I checked.