Well the LTB doesn’t apply in certain situations…it’s been a while since I’ve read the rules but certain units / rentals are exempt from LTB regulations IIRC.Will the LTB enforce the no drinking ???

View attachment 50432

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

COVID and the housing market

- Thread starter mimico_polak

- Start date

D

Deleted member 50930

Guest

Identify as female - problem solved.

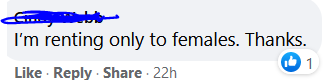

Sounds like a discrimination grievance is in order….

EDIT: I can’t believe someone would be stupid enough to put that in writing…

To what end? You don't want to start off a relationship with the landlord ****** at you. It would be helpful if the landlord got a meaningful fine (thousands) to amend their attitude but I would be shocked if that happened. Imo, spending anymore time on that property is not worthwhile.Sounds like a discrimination grievance is in order….

As for drinking. What is the LTB position on religion? If a landlord argues that activity xxx is against their religion, what is the board saying?

I agree with you 100% @GreyGhost thats the property isn’t worth the effort.

If I was bored I’d submit the documentation to the authority responsible and leave it at that. No chance in hell I’d want to live in that apartment with that start to the relationship.

As for LTB…religion is definitely a big no no for discrimination. Drinking isn’t.

It’s nothing more than an attempt by the owner to minimize chance of issues with drunks.

When I was renting out units I couldn’t believe how many people I had to let know that ‘no, the landlord you saw before me CANNOT charge you a security fee’.

People say a lot of landlords are clueless…many renters have no clue to their own rights.

If I was bored I’d submit the documentation to the authority responsible and leave it at that. No chance in hell I’d want to live in that apartment with that start to the relationship.

As for LTB…religion is definitely a big no no for discrimination. Drinking isn’t.

It’s nothing more than an attempt by the owner to minimize chance of issues with drunks.

When I was renting out units I couldn’t believe how many people I had to let know that ‘no, the landlord you saw before me CANNOT charge you a security fee’.

People say a lot of landlords are clueless…many renters have no clue to their own rights.

When I used to rent there were countless ads specifically looking for just females. If I was a single female renting a portion of my house out, I would also have some pretty specific guidelines about who I would rent to. But for self contained units like condos or full houses not sure if there is language that specifies against this. Maybe guys tend to trash places more often. I lived with 3 girls when I first moved out - made things so easy finding a house to rent.Sounds like a discrimination grievance is in order….

EDIT: I can’t believe someone would be stupid enough to put that in writing…

D

Deleted member 50930

Guest

Another recent story. I offered the landlord ~$150 less / month and the landlord replied back they are actually increasing the rent due to high demand and the ad is wrong

Well that sucks. I don't have a good answer for that one though. If the landlord can get quality candidates for hundreds more a month, why would they want to take less?Another recent story. I offered the landlord ~$150 less / month and the landlord replied back they are actually increasing the rent due to high demand and the ad is wrong

I saw some rooms for rent in a shared house for $550. Save 1500 a month over renting your own apartment and keep building the war chest.

Could have also been a response to what was perceived as a low ball offer.Another recent story. I offered the landlord ~$150 less / month and the landlord replied back they are actually increasing the rent due to high demand and the ad is wrong

Maybe guys tend to trash places more often.

Maybe so, but I had a female roommate once and she was the messiest, most slovenly person I've ever lived with. Never cleaned her room, friggin hair everywhere. Nice person, we got along well, but I'd never live with her again.

Mad Mike

Well-known member

Maybe... but probably not on the buy a more expensive house. Expensive houses have not appreciated as much as entry levels. If you bought a 3000sq house in the north part of York Region in 2000 for $350 it would be worth $1.5M today. A $115K starter would be $700K - 3 of them $2.1M total.That's an argument for buying a more expensive house and/or improving the one you have. You made your 80K a year whether your mortgage was 500k or zero with the 500k invested elsewhere.

Another thing to consider is risk - the higher end property will suffer cataclysmic losses in a market correction, the low end ones probably nothing, may even go up as it did in the 1994 correction.

If my house was bigger than my needs, I'd sell it and buy 2 smaller rather than one bigger.

While you will have more gross dollars with multiple houses, as long as the primary residence tax exemption remains in place, I suspect the difference in net dollars after you liquidate all properties wouldn't be worth the hassle. In your example, you owe CG tax on 1.17M so ~300K in tax so still ahead with multiple dwellings but not as far as it looked initially. If you are talking purely investment properties then yes, more cheap dwellings will almost always blow away the return of a more expensive rental dwelling.Maybe... but probably not on the buy a more expensive house. Expensive houses have not appreciated as much as entry levels. If you bought a 3000sq house in the north part of York Region in 2000 for $350 it would be worth $1.5M today. A $115K starter would be $700K - 3 of them $2.1M total.

Another thing to consider is risk - the higher end property will suffer cataclysmic losses in a market correction, the low end ones probably nothing, may even go up as it did in the 1994 correction.

If my house was bigger than my needs, I'd sell it and buy 2 smaller rather than one bigger.

I'm also not convinced about your theory on price appreciation. I previously believed that but I have been proven wrong in instances where I ran the numbers. Also, for most people, the bank is happy to give you a lot of money for your primary home but much less excited to give you lots of money to buy rental properties. If your theoretical investor was sitting on 350 cash at the beginning, multiple properties could work, if they were sitting on 35 (10% on the 350K house), they could not get three at 115 as they don't have enough down.

Yup can confirm. Have had multiple requests out to the brokers that I want to buy a rental / investment property. They’re not as willing to hand out cash as before…

Id assume I’ve got 600k equity in my house, but because single income is low 6 figures they’re not interested…too bad as I really want another property.

Id assume I’ve got 600k equity in my house, but because single income is low 6 figures they’re not interested…too bad as I really want another property.

Very possible. Emailed a guy about something he was selling for $500…Could have also been a response to what was perceived as a low ball offer.

- hey would you take $400?

- why? I’ve got 50 other people offering me full price? If they all bail I’ll sell to you for $400

The other problem with the big house is market correction. Years ago a friend was talking to a guy that had a house valued at four million but he got downsized and went to sell. Real estate told him not to expect a million dollars. The big stuff got slammed. The average family home got hit but nowhere nearly as bad. As the high end jobs topple the guys in the four million dollar houses want to move to the blue collar neighbourhoods.Maybe... but probably not on the buy a more expensive house. Expensive houses have not appreciated as much as entry levels. If you bought a 3000sq house in the north part of York Region in 2000 for $350 it would be worth $1.5M today. A $115K starter would be $700K - 3 of them $2.1M total.

Another thing to consider is risk - the higher end property will suffer cataclysmic losses in a market correction, the low end ones probably nothing, may even go up as it did in the 1994 correction.

If my house was bigger than my needs, I'd sell it and buy 2 smaller rather than one bigger.

Well the LTB doesn’t apply in certain situations…it’s been a while since I’ve read the rules but certain units / rentals are exempt from LTB regulations IIRC.

A friend was renting rooms pre covid and rooming houses come under a different set of rules. The landlord has more discretion. Apartments are a different matter.

IIRC he was getting $650 a month / room. I may tell him about the foreign students on $20K allowances.

Short of hookers and blow how does one spend $20,000 a month?

Oh wait, 20 years old, Ferrari, insurance....

Somethings weird about that story. The only reason you need to downsize is if your mortgage/operating/maintenance/tax is more than you can pay. Was he sitting on mortgage over 1M so he had big payments and negative equity? How did the price collapse so far? Was it crazy pricing at the beginning (eg. a neighbourhood in a frenzy as the next hot thing and that plan collapsed?). Did they find a nuclear waste dump in the back yard?The other problem with the big house is market correction. Years ago a friend was talking to a guy that had a house valued at four million but he got downsized and went to sell. Real estate told him not to expect a million dollars. The big stuff got slammed. The average family home got hit but nowhere nearly as bad. As the high end jobs topple the guys in the four million dollar houses want to move to the blue collar neighbourhoods.

I can't recall the year many decades ago but it was the time to buy a mansion if you had cash and could afford the upkeep. I bought an industrial condo for half the price a year earlier and others in the complex went for half of that.Somethings weird about that story. The only reason you need to downsize is if your mortgage/operating/maintenance/tax is more than you can pay. Was he sitting on mortgage over 1M so he had big payments and negative equity? How did the price collapse so far? Was it crazy pricing at the beginning (eg. a neighbourhood in a frenzy as the next hot thing and that plan collapsed?). Did they find a nuclear waste dump in the back yard?

I know a guy that bought a marina at peak prices and watched it go downhill. To meet his bank payments he sold a brand new $70K boat for half price.

I passed on a waterfront cottage with boathouse (Water access in Muskoka) for $69K. Now add $400K

I can't see how it couldn't happen again if interest rates went to 1980 levels of 22%

Mad Mike

Well-known member

Exactly. In the last few corrections the big $$$ homes got whacked, the rats fled their big houses for cheaper housing, entry level prices were forced up. In 93, the last big correction I recall, I did that, sold a house for $300 that I paid $375 to build 3 years prior. Bought a smaller place for $150 that sold for $135 the year before. Doesn't sound like big money these days, but for many a 75K loss left them owing the bank after selling.The other problem with the big house is market correction. Years ago a friend was talking to a guy that had a house valued at four million but he got downsized and went to sell. Real estate told him not to expect a million dollars. The big stuff got slammed. The average family home got hit but nowhere nearly as bad. As the high end jobs topple the guys in the four million dollar houses want to move to the blue collar neighbourhoods.