Relax

Well-known member

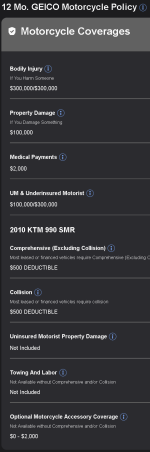

Are you comparing apples to apples though? It’s common to hear stories of cheap USA insurance, kids paying $500 a year on supersports/blacklisted bikes, etc, but the side of the story that you never hear is that they have $50,000 in liability and basically almost zero accident benefits and hospital coverage. So, if they actually got into a wreck, a lot of cheap USA policies are functionally useless.

I have a buddy riding a big touring bike In the US and he’s paying $1000/year for good solid real insurance. After the current exchange, that’s not a whole lot less than what I am paying for top of the line coverage here on my bike.

Exactly. I recently got a quote for US insurance and it was crazy expensive for similar coverage to what I currently have in Ontario. Cheap for basically no coverage, but once you start adding things up, it skyrockets (if they even offer it).