Banks often don't have much interest in businesses that are not in a situation for long term (or even short term in many cases) sustainability, producing (potentially, if they're successful) a product that is subject to high price volatility.

I think that's just called common sense business decisions, and nothing else.

The fact, as you mention, that some smaller banks in the USA with less regulatory overhead are willing to serve these potentially high risk businesses, and the fact that said small banks frequently fail, should speak volumes.

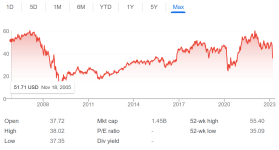

In a somewhat related note, I follow a lot of other forums and such for the RV industry and a lot of Americans are now starting to yell loudly that they're having trouble getting banks to finance that shiny new RV that they want to rush out and buy - why? Because the industry is teetering on the edge of disaster after an artificial bubble that was created during Covid where manufacturers couldn't make units fast enough, dealers jacked prices by anywhere from 20 to 50% taking advantage of the hysteria, and now that house of cards is all falling down - people that paid $50K for a trailer during covid that was worth $30K in normal pre-pandemic times and is now only worth $20K (a double whammy of post covid price correction plus the customary horrible first 2-3 year depreciation which is common in the RV industry) are struggling to make payments and coming to the realization that they're massively upside down on an asset that they still owe the same amount for another 10...15....20 years. And many are thinking about walking away from them and letting the bank repo them instead.

So, is a small "less regulatory burdened" bank still willing to lend to people in a market that is on the verge of seeing an impending collapse of epic proportions where the value of the financed product is going to crater being "easy to deal with", or are they being incredibly stupid simply because they can get away with it in the interest of maximizing profits and "shareholder value" (*cough*, greed) even if it means that a year or two from now they risk collapse, screwing a lot of their customers along the way?