I'm not surprised but I would try for better. My RRSP has 1/3/5 annual rates of return of 25.15/37.28/24.62. Mainly buy and hold stocks. This year is much worse (down <10% right now).View attachment 54789

This is my return on money put into RRSP that’s invested in a medium-high risk portfolio through Scotiabank. Return seems low to me but correct me if I’m wrong (I’ve been busy with a new baby instead of watching markets). Any recommendations on what to change/move is welcome (keeping in mind it’s an rrsp).

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stocks

- Thread starter Boots

- Start date

D

Deleted member 54626

Guest

Your returns are not that good for a medium-high risk portfolio. Its not easy to know what is the best way to move forward these days, so I can't really recommend anything. The markets have been stupidly volatile for awhile now. I read this morning that when interest rates are rising, REITs seem to be a little more popular with investors. I am hopeful that we will see a gentle rally after this most recent bear market but honestly I think we will just see more volatility.

I actually toyed / thought about the idea of selling everything to just pay the house off...however after tax and witholding fees of the RSPs...I may not have enough to do it. But could probably drop it down to < 100k.

I'm tempted LoL.

Bad bad bad

-8 percent last 30 days still up 26 percent 6 months meh hopefully will see this rally continue lspd and gold.to are my big drags.Propably the worst short-term return of my life. In the last month or so, down 14%.

LSPD up 28% today. I didn't buy any yesterday though so I am still way down.

Sent from my Pixel 5 using Tapatalk

I’m just waiting for 50k to transfer from Tangerine and then another 100k from previous employer.

Then I’ll start buying.

Then I’ll start buying.

D

Deleted member 54626

Guest

What rally? The last 36 hours? Its just a blip like all the other blips of hyper-volatility driven mainly by algos and whales.-8 percent last 30 days still up 26 percent 6 months meh hopefully will see this rally continue lspd and gold.to are my big drags.

Sent from my Pixel 5 using Tapatalk

I think we are in for a continued bear market. I sold everything. Albeit too late. I'm probably wrong.

Most of my holdings are reporting record earnings I think we are at the bottom this time for what I have in my portfolio but am probably wrong.What rally? The last 36 hours? Its just a blip like all the other blips of hyper-volatility driven mainly by algos and whales.

I think we are in for a continued bear market. I sold everything. Albeit too late. I'm probably wrong.

Sent from my Pixel 5 using Tapatalk

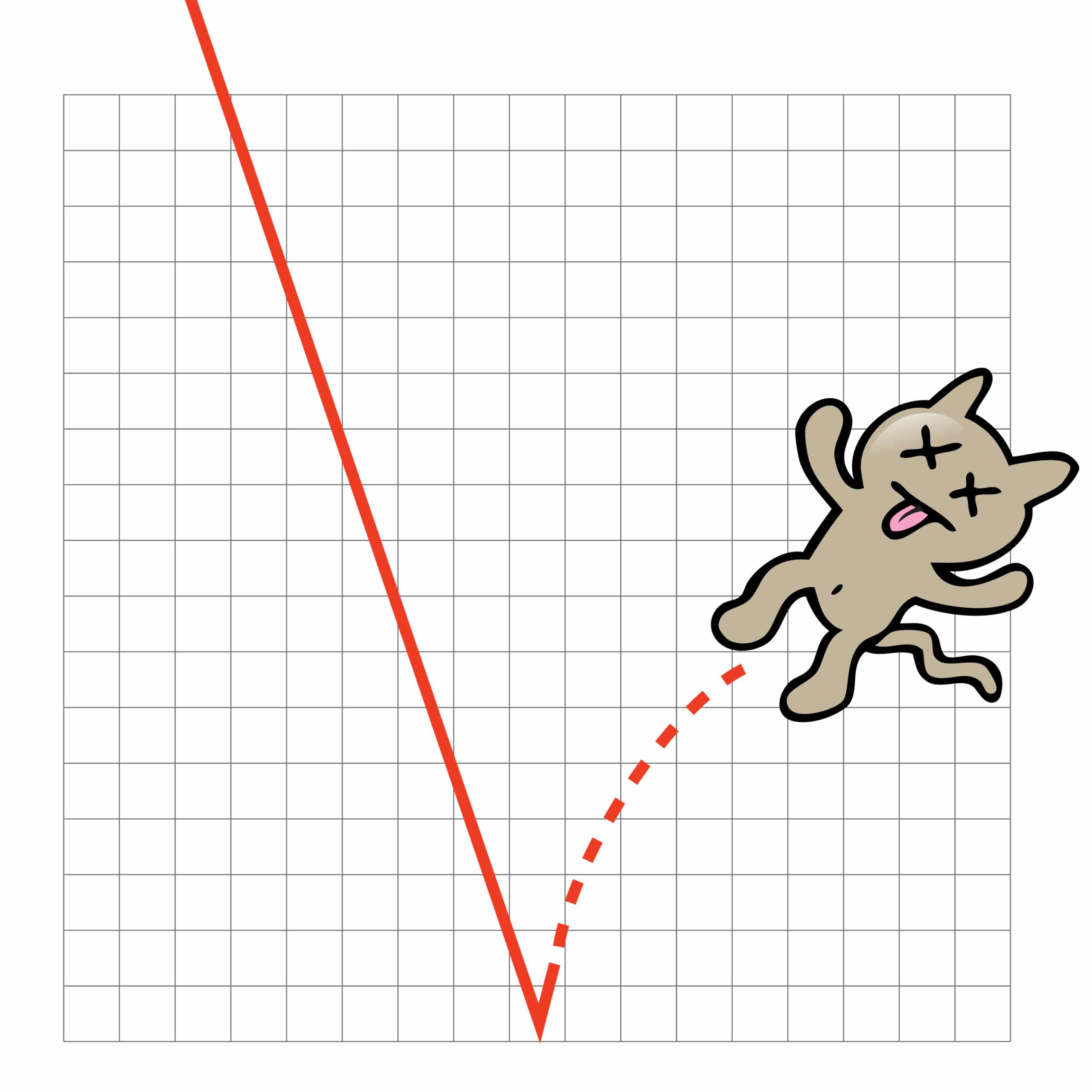

Thankfully my borrow to invest securities are doing ok (~5 months in up 6% as unrealized CG and paid off 4% of the loan with dividends). My buy and hold securities on the other hand

Thankfully my borrow to invest securities are doing ok (~5 months in up 6% as unrealized CG and paid off 4% of the loan with dividends). My buy and hold securities on the other hand. They've done a bit of a bounce but I've lost about a year of gains.

Well, given that we're at the tail-end of the longest bull market in history, a year's loss is not a big deal.

Plenty of buying opportunities ahead for those who've kept their powder dry.

D

Deleted member 54626

Guest

As of recently, I am all in cash now. Lost a lot. Will need to see a definite trend before I buy anything.

Still waiting for that transfer to finish up....

Almost back to where I was before the drop today was good.Well, given that we're at the tail-end of the longest bull market in history, a year's loss is not a big deal.

Plenty of buying opportunities ahead for those who've kept their powder dry.

Sent from my Pixel 5 using Tapatalk

D

Deleted member 54626

Guest

All I can say is, if I would have just kept what I bought back in 2013 when I started playing the stock market, and ignored it, I would have made at least 250K. But, no, I had to monkey around and do stupid stuff like selling after anything dropped for 3 days straight. All I really would have needed was my GOOG, I would have been OK.

All I can say is, if I would have just kept what I bought back in 2013 when I started playing the stock market, and ignored it, I would have made at least 250K. But, no, I had to monkey around and do stupid stuff like selling after anything dropped for 3 days straight. All I really would have needed was my GOOG, I would have been OK.

Playing the Coulda-Woulda-Shoulda-What-If game is like repeatedly bashing your head against the wall. It doesn't lead to anything good.

We'd all be trillionaires today if we only we... [insert any buy-low-sell-high scenario here]

As long as no one goes in too heavily with gambling away emergency funds or the kids college tuition, you're probably ok. I'm hearing too many stories from friends-of-friends who are in the red with money they can't afford to lose. Even if the market stabilizes and picks back up (in the next 5-10 years), there's still more losses to be had along the way.

Since I can't afford a house, might as well lightly invest in REITs...

Since I can't afford a house, might as well lightly invest in REITs...

Borrow to generate dividends to payoff loan ~6 month update (some loan pulled at beginning of Dec, some at end of Dec). Paid off ~5% (all dividends go to loan). Depending on the month, dividends are three to eight times interest. Unrealized cap gain ~10%. So far, so good.

How's that work? Each company pays dividends at a different time. So I guess you just take your own cash to pay off the loan, and then re-pay yourself once each dividend is paid out?Borrow to generate dividends to payoff loan ~6 month update (some loan pulled at beginning of Dec, some at end of Dec). Paid off ~5% (all dividends go to loan). Unrealized cap gain ~10%. So far, so good.