There is always an area of concern, you look at a property in August, take possesion in October, in April you find out the backyard floods annually.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

COVID and the housing market

- Thread starter mimico_polak

- Start date

Right now the backyard is a foot deep there have been years where the couldn't cut the grass because the lawn tractor just sinks and gets stuck.There is always an area of concern, you look at a property in August, take possesion in October, in April you find out the backyard floods annually.

Sent from my Pixel 5 using Tapatalk

D

Deleted member 50930

Guest

Rim Park Area has for sale signs everywhere

Amazing how much these ~20 year old houses are worth now

Also seeing more high-end cars...

Amazing how much these ~20 year old houses are worth now

Also seeing more high-end cars...

Last edited by a moderator:

A friend in Port Credit had a lot that did the same but he just about lost his wife. She put on gum boots and waded in only to find that she sank into the soft mud. He managed to drag her out but the boots stayed until the lot dried out.Right now the backyard is a foot deep there have been years where the couldn't cut the grass because the lawn tractor just sinks and gets stuck.

Sent from my Pixel 5 using Tapatalk

Last edited:

House next door is up for sale and one up the street. Will be interesting to see how they sell.

Sent from my iPhone using Tapatalk

Our neighbourhood will have no listings and then one comes up and the price raises eyebrows. When it sells above asking suddenly it seems like a bunch of people decide to either cash in or are timing the market. Are the prices a spike, bubble or the new reality?

D

Deleted member 50930

Guest

Our neighbourhood will have no listings and then one comes up and the price raises eyebrows. When it sells above asking suddenly it seems like a bunch of people decide to either cash in or are timing the market. Are the prices a spike, bubble or the new reality?

My realtor told me prices will level out but it won't crash down

So I am preparing for ~$500-650k and positioning my career to be WFH or as remote as possible

While the prices are climbing like a bubble, I don't see the path for it to pop in much of the GTA.Our neighbourhood will have no listings and then one comes up and the price raises eyebrows. When it sells above asking suddenly it seems like a bunch of people decide to either cash in or are timing the market. Are the prices a spike, bubble or the new reality?

They aren't making more land so single-family home prices can't lower by meaningful dilution due to significant alternatives coming on line. I wouldn't be surprised if the prices stagnated at some point (possibly for a very long time) as the rocket ran out of gas.

As for the KW craziness, that may work out too. Given all the people that have moved there, maybe more companies will open local offices instead of forcing the masses to commute.

D

Deleted member 50930

Guest

While the prices are climbing like a bubble, I don't see the path for it to pop in much of the GTA.

They aren't making more land so single-family home prices can't lower by meaningful dilution due to significant alternatives coming on line. I wouldn't be surprised if the prices stagnated at some point (possibly for a very long time) as the rocket ran out of gas.

As for the KW craziness, that may work out too. Given all the people that have moved there, maybe more companies will open local offices instead of forcing the masses to commute.

The high-paying tech jobs here are 99.999% remote.

Not as nuts as the GTA but we bought our house for about $220k 16 years ago in Ktown. Local houses are now selling for $750-850k in part because some from the GTA are selling up and moving here for the “cheaper” housing. Our house is bigger (extension) with a larger yard than many of these. It’s made us wonder about selling up and moving to the outskirts to get a place with more land. Big downsides are we have a great neighbourhood and are 5 mins from work and a (40min) walk into the city centre.

D

Deleted member 50930

Guest

Not as nuts as the GTA but we bought our house for about $220k 16 years ago in Ktown. Local houses are now selling for $750-850k in part because some from the GTA are selling up and moving here for the “cheaper” housing. Our house is bigger (extension) with a larger yard than many of these. It’s made us wonder about selling up and moving to the outskirts to get a place with more land. Big downsides are we have a great neighbourhood and are 5 mins from work and a (40min) walk into the city centre.

How far outskirts?

I think he's talking about a different KTown than you are interested in. I suspect he is near Kingston. If he moved up by trials, he could also become a hermit.How far outskirts?

We don't want your type up here in God's country. Just kidding of course; bring your guns.Not as nuts as the GTA but we bought our house for about $220k 16 years ago in Ktown. Local houses are now selling for $750-850k in part because some from the GTA are selling up and moving here for the “cheaper” housing. Our house is bigger (extension) with a larger yard than many of these. It’s made us wonder about selling up and moving to the outskirts to get a place with more land. Big downsides are we have a great neighbourhood and are 5 mins from work and a (40min) walk into the city centre.

We don't want your type up here in God's country. Just kidding of course; bring your guns.

I was going to try to be your neighbour and move in with my pet skunk breeding business idea.

It's illegal to breed skunks in Ontario. Politicians don't like the competition.I was going to try to be your neighbour and move in with my pet skunk breeding business idea.

I think he's talking about a different KTown than you are interested in. I suspect he is near Kingston. If he moved up by trials, he could also become a hermit.

do you think he’d let me have a go of his seatless clown bikes?

D

Deleted member 50930

Guest

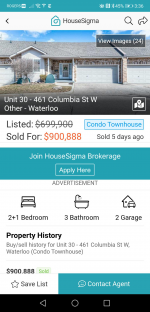

Holy ****....that’s insane in Waterloo.....and it’s a condo townhouse!

Id assume/hope people are locking in these ridiculous rates for 5 years at least. You can shave a stupid amount of principal in that timeframe if you’re disciplined.

Hell that’s what I’d do.

Id assume/hope people are locking in these ridiculous rates for 5 years at least. You can shave a stupid amount of principal in that timeframe if you’re disciplined.

Hell that’s what I’d do.

D

Deleted member 50930

Guest

Almost a million for a semi or townhouse?

I'm waiting for interest rates to go up about 3% and then snag deals when most people are underwater. People are stretched to the limit. It wouldn't take much to turn things upside down.

While economic prospects have improved, the Governing Council judges that the recovery continues to require extraordinary monetary policy support. We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In the Bank’s January projection, this does not happen until into 2023.