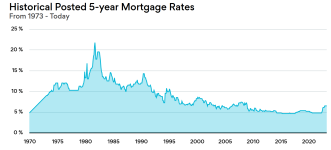

The funny part to me is the rates right now are really not that high or maybe even unhealthy overall. In the 20 or so years I have owned property twice I had to pay over 5% for my mortgage. here is some data from ratehub since 1970:

View attachment 59956

Not discounted rates in the above so the typical rate would have been lower for a five year fixed.

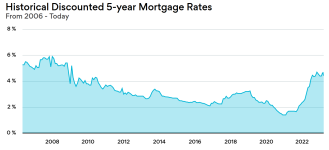

Shorter time frame but this time discounted rates:

View attachment 59957

No doubt people got drunk and over extended on crazy low rates over the last decade but this is not like '75 to '92.... Those crazy low rates are one of the factors in historically high prices--so low crazy rates were in part pricing people out of the market.

The media is full on "the sky is falling" these days, is it really? I think this will help us get us back to a healthy market. No doubt though there will be pain for those that overextended thinking ~2% was going to be in perpetuity.

:format(webp)/https://www.thestar.com/content/dam/thestar/news/gta/2023/03/22/when-your-mortgage-lender-wants-out-realtors-report-a-spike-in-gta-forced-sales/ci_powerofsale_2.jpg)