What’s the cheapest/most secure way to transfer maybe 60k in foreign currency to Canada?

Looking to minimize exchange fees and and handling costs etc.

Looking to minimize exchange fees and and handling costs etc.

Thanks for the reply!Is it USD? if so, look up Norbert's Gambit.

Norbert's Gambit with Questrade: Step-By-Step Guide (2025)

Norbert’s Gambit is a technique that many Canadian investors use to cheaply exchange between CAD and USD. Here is a step-by-step guide.wealthsavvy.ca

You can get the spot rate for a minimum trade fee of $9.99 or whatever your brokerage charges.

Any other currency (EUR, GBP, etc) you need a brokerage that can execute trades on that country's exchange, as well as find a suitable dual-listed stock or ETF.

Swift wire transfer, fees are about $20 one the send and another $20 on the receive. Best to receive to an account denominated in same currency. USD accounts are usually free or cheap, other currency accounts at banks are typically only available if your setup with their wealth or investment banking.What’s the cheapest/most secure way to transfer maybe 60k in foreign currency to Canada?

Looking to minimize exchange fees and and handling costs etc.

TD doesn't charge me for USD conversion... but you get hosed on any other currency... like GBP. Maybe see if you can get the payment in USD.

Swift is the easiest. Send or receive funds with your on-line banking.

The way I understand it, no matter who you use for the transfer, it's going over the swift network... why add more steps?

TD doesn't charge me for USD conversion... but you get hosed on any other currency... like GBP. Maybe see if you can get the payment in USD.

Not to worry I checked, I was expecting 5% on USD and the last two transfers I received (one for $11,200USD, and the second was $6600USD) there was a $7.20 conversion fee on both. Might be my pensioner's account. I know I've paid more in the past.Check again. They most definitely do.

It might be cheaper to convert it to USD in Britain, THEN send it.Not going to be possible. It’s sitting in a British account.

... or the IOM Bank. No conversion, no taxes

Then go visit your money every May and August... the trip is now tax deductable

What?Swift is the easiest. Send or receive funds with your on-line banking.

The way I understand it, no matter who you use for the transfer, it's going over the swift network... why add more steps?

TD doesn't charge me for USD conversion... but you get hosed on any other currency... like GBP. Maybe see if you can get the payment in USD.

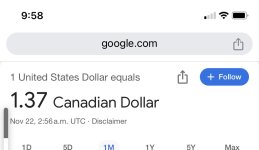

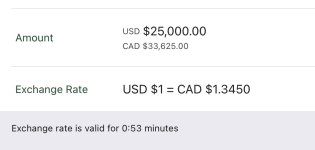

Not that high. Here’s the interbank:Check again. They most definitely do.

On the order of 4.344% in each direction if you're not a President's Account member, 3.1% if you are.

TD

apps.td.com

On $60,000 USD, that's $2,600 in conversion fees.

I haven’t had to watch it in a few yrs but when we had a US home and needed to move money often we watched exchange rates like a religion.

Now that my company has hundreds of US customers and we move tens of millions of dollars , the exchange and fees can be the value of a new car .

If Banks do anything for free it’s news to me .

Sent from my iPhone using GTAMotorcycle.com