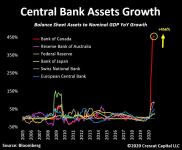

So we all know that the debt by all Governments around the world has been going through the roof to pay for all the Covid-19 financial relief for both businesses and individuals.

We also know that since there's no longer a Gold Standard to mandate having physical gold to be able to initiate printing of paper money that the presses are spinning overtime to print money hand over fist and so the so-called "debt" continues to go up and up such that we talk about our grand kids still paying off this Covid-19 incurred debt.

But is it ALL truly debt?

In my mind, I see it as one branch of the Gov't (the Finance Dept) owing money to another branch (the Bank of Canada that prints the money). It's the left pocket owing the right pocket.

Yes, there's legitimate debt issued to other countries and individuals in the forms of bonds, t-bills, etc. but I'd say that by far it's just phantom debt. It's like your savings account loaning your chequing account funds to pay the bills.

How could it be otherwise when the whole world is experiencing the SAME issues having to pay financial relief? If phony debt didn't exist, you'd always have equilibrium in that 1 country would be be the loaner and the other the debtor, but I suspect if you added up all the $ lent and all the $ borrowed in the world, it would not be zero.

I can't see it being otherwise and that's why the $ is spent so superfluously and hopefully the Bank of Canada will just forgive the Finance Dept's loans at some point ... I pray for my kids and future grand kids that I'm right.

We also know that since there's no longer a Gold Standard to mandate having physical gold to be able to initiate printing of paper money that the presses are spinning overtime to print money hand over fist and so the so-called "debt" continues to go up and up such that we talk about our grand kids still paying off this Covid-19 incurred debt.

But is it ALL truly debt?

In my mind, I see it as one branch of the Gov't (the Finance Dept) owing money to another branch (the Bank of Canada that prints the money). It's the left pocket owing the right pocket.

Yes, there's legitimate debt issued to other countries and individuals in the forms of bonds, t-bills, etc. but I'd say that by far it's just phantom debt. It's like your savings account loaning your chequing account funds to pay the bills.

How could it be otherwise when the whole world is experiencing the SAME issues having to pay financial relief? If phony debt didn't exist, you'd always have equilibrium in that 1 country would be be the loaner and the other the debtor, but I suspect if you added up all the $ lent and all the $ borrowed in the world, it would not be zero.

I can't see it being otherwise and that's why the $ is spent so superfluously and hopefully the Bank of Canada will just forgive the Finance Dept's loans at some point ... I pray for my kids and future grand kids that I'm right.